The post NCFS Chart of Accounts Sortable by Type first appeared on Esmeralda Colombiana.

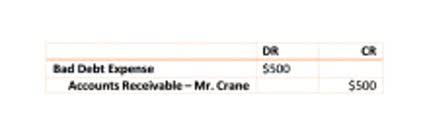

]]>Generally a long term liability account containing the face amount, par amount, or maturity amount of the bonds issued by a company that are outstanding as of the balance sheet date. The credit balance in this account comes from the entry wherein Bad Debts Expense is debited. The amount in this entry may be a percentage of sales or it might be based on an aging analysis of the accounts receivables (also referred to as a percentage of receivables). For example, the office supplies expense might be assigned the code 5600 or a credit card liability the code 2200. The group refers to the classification of the account into one of the headings shown below.

The Chart of Accounts (COA) is a foundational tool in accounting, serving as the backbone of a company’s financial recordkeeping system. This guide offers an in-depth exploration of the chart of accounts, providing definitions, an example, and a downloadable template to enhance your financial organization and reporting. You must make a double entry each time you record a transaction in the chart of accounts.

Where can you find expenses in reporting?

This account is to be used by Administrative Office of the Courts (AOC) only. This post is intended to be used for informational purposes only and does not constitute as legal, business, or tax advice. Please consult your attorney, business advisor, or tax advisor with respect to matters referenced in our content. 10 business development tips for attorneys Xendoo assumes no liability for any actions taken in reliance upon the information contained herein. Our team is ready to learn about your business and guide you to the right solution.

Easy-To-Use Platform

Expense accounts are all of the money and resources you spend in the process of generating revenues, i.e. utilities, wages and rent. Revenue accounts keep track of any income your business brings in from the sale of goods, services or rent. A related account is Insurance Expense, which appears on the income statement. The amount in the Insurance Expense account should report the amount of insurance expense expiring during the period indicated in the heading of the income statement.

Discover corporate and business credit cards

Income tends to be the category that business owners underutilise the most. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers.

AA Organizational Structure & Basic Settings

Some valuable items that cannot be measured and expressed in dollars include the company’s outstanding reputation, its customer base, the value of successful consumer brands, and its management team. As a result these items are not reported among the assets appearing on the balance sheet. Insurance Expense, Wages Expense, Advertising Expense, Interest Expense are expenses matched with the period of time in the heading of the income statement. Under the accrual basis of accounting, the matching is NOT based on the date that the expenses are paid.

- We are life-long learners, passionate about teamwork and excellence in our respective roles, with a solution-oriented approach to challenges.

- The following examples illustrate how a fictional business—XYZ—might record transactions in its chart of accounts.

- Sets the limits for transaction posting, within which users can post transactions, thereby helping to prevent errors, unauthorized activities, and fraud.

- This process provides the initial configuration and setup of the extended withholding tax functionality, including relevant general ledger accounts, formulas, codes, and definitions of withholding tax type.

- Moreover, it can change over time for the same company as it adds more accounts to reflect changes in its business activities.

- In manufacturing, the production process involves different stages, such as raw materials, work in progress, and finished goods.

Cash Flow Statement

Surprisingly, credit card interest rates are very high, averaging 23 percent annually in 2023. Indeed, their rates are far higher than the rates on any other major type of loan or bond. In our recent research paper, we address this question using granular account-level data on 330 million monthly credit card accounts. Utilizes a cash journal to manage and record accounts payable-related cash transactions, including payments made outside the standard payment process and petty cash transactions.

In 1494, an Italian mathematician, Luca Pacioli, wrote a book providing suggestions of how merchants could keep their records. It was like the first try to introduce double-entry bookkeeping, being a significant milestone. It brought the concept of recording transactions with corresponding debits and credits, allowing for more accurate financial records. While Pacioli’s work laid the foundation for modern accounting, a standardized chart of accounts had yet to emerge.

- This section outlines the key areas within Accounts Payable in SAP FICO, providing definitions and transaction codes for each.

- These categories correspond to the major sections of financial statements (balance sheet and income statement).

- If the author has no such interests to disclose, no statement is provided.

- The more accounts are added to the chart and the more complex the numbering system is, the more difficult it will be to keep track of them and actually use the accounting system.

- Some common examples of these types of securities are common stock, preferred stock, and convertible preferred stock.

- This material has been prepared for informational purposes only, and should not be relied upon for tax, legal, or investment purposes.

- Although not seen in this example chart of accounts, after the Owner’s equity accounts, you will see a list of the Income Statement accounts.

A company’s organization chart can serve as the outline for its accounting chart of accounts. For example, if a company divides its business into ten departments (production, marketing, human resources, etc.), each department will likely be accountable for its own expenses (salaries, supplies, phone, etc.). Each department will have its own phone expense account, its own salaries expense, etc.

In this sample chart of accounts template the sub-group column divides each group into the categories shown in the listings below. The purpose of the sub-group is to categorize each account into classifications that you might need to present the balance sheet and income statement in accounting reports. Decide on the account categories you want to include in your chart of accounts.

These resources have economic value and are expected to provide future benefits. These can include cash, inventory, equipment, buildings, and investments. If you remember those large accounting books of old times where you would write all the transactions, like how much you sold, earned, spent, and so on – that’s what the general ledger is. The only difference is that today, you don’t need pen and paper (or quill and paper, though I like that idea) and use accounting software (or any other electronic means of accounting) to do your books. The general ledger is the central hub where all financial transactions are recorded. It contains individual account summaries, showing debit and credit entries to each account.

House Banks & Check Management

Revenue and expense accounts tend to follow the standard of first listing the items most closely related to the operations of the business. In some cases, part or all of the expense accounts simply are listed in alphabetical order. That part of the accounting system which contains the balance sheet and income statement accounts used for recording transactions. Accounting software frequently includes sample charts of accounts for various types of businesses. It is expected that a company will expand and/or modify these sample charts of accounts so that the specific needs of the company are met.

In this respect, there is an advantage in organizing the chart of accounts with a higher initial level of detail. For example, to report the cost of goods sold a manufacturing business will have accounts for its various manufacturing costs whereas a retailer will have accounts for the purchase of its stock merchandise. Many industry associations publish recommended charts of accounts for their respective industries in order to establish a consistent standard of comparison among firms in their industry. Accounting software packages often come with a selection of predefined account charts for various types of businesses. Operating expenses are the costs of a company’s main operations that have been used up during the period indicated on the income statement.

The first digit of the number signifies if it is an asset, liability, etc. For example, if the first digit is a “1” it is an asset, if the first digit is a how to account for cash receipts “3” it is a revenue account, etc. The company decided to include a column to indicate whether a debit or credit will increase the amount in the account.

To help illustrate the types of accounts that can be included in a chart of accounts, here are some common examples categorized by type. While these examples are not exhaustive and may vary depending on the specific needs and nature of the business, they can provide a useful starting point for building a chart of accounts. Credit cards play a crucial role in U.S. consumer finance, with 74 percent of adults having at least one. They serve as the main method of payment for most individuals, accounting for 70 percent of retail spending. They are also the primary source of unsecured borrowing, with 60 percent of accounts carrying a balance from one month to the next.

The total assets amount represents the value of all the company’s resources. When a company purchases inventory on credit, the Inventory account is debited to increase it, and the Accounts Payable account is credited to record the liability to pay for the inventory in the future. QuickBooks Online automatically sets up a chart of accounts for you based on your business, with the option to customise it as needed.

The post NCFS Chart of Accounts Sortable by Type first appeared on Esmeralda Colombiana.

]]>The post Automating Bookkeeping: The Top 4 Use Cases And Benefits In 2025 first appeared on Esmeralda Colombiana.

]]>Use Technology when Employees Need it Most

Corporations can get a clear picture of their financial health with the help of accounting automation software. As a bonus, it provides in-depth knowledge of their business performance for making informed, data-driven choices. Having this data available at any moment helps pinpoint improvement areas.

Robotic Process Automation

Use built-in compliance checks in automation tools to flag potential issues before submitting tax returns. Conduct frequent security audits to identify and address potential weaknesses in automated systems. Natural language processing enables chatbots to handle basic client inquiries, freeing up accountants for more complex tasks.

- Small business owners should focus on staying up-to-date with current trends to maximize accounting efficiencies and processes.

- API-first platforms like Xero and QuickBooks Online provide extensive documentation and developer tools, facilitating custom integrations.

- Just a heads up, you aren’t being replaced by AI using our software.

- Regular API updates and backwards compatibility are crucial for long-term stability.

- In this scenario, they would have more time to plan strategies, handle bank accounts, and improve communication with coworkers.

- The accounting and financial industries are rapidly adopting cloud computing and AI applications.

Automated Accounting Software: A Game Changer

By automating tasks like data entry and reconciliation, AI saves time and gives you insights that help with decisions. Compliance teams also benefit from AI by automating the monitoring of transactions to flag potential regulatory breaches in real-time. The world of accounting has changed dramatically over the last few years. From the COVID-19 pandemic to an increasing focus on digitalization – the way businesses utilize their accounting resources continues to evolve. Small business owners should focus on staying up-to-date with current trends to maximize accounting efficiencies and processes. The bookkeeping and accounting industry spends more than $40 billion on payroll services.

Nomi’s commitment to innovation ensures that accountants always have access to the best tools available. With this guide, selecting the ideal accounting software becomes a more manageable task. Each software has its strengths and serves specific purposes, ensuring you find one that aligns with your needs. By leveraging these tools, you can enhance your bookkeeping processes and maintain a healthy financial workflow in 2023.

- Even though multiple softwares already exist that automate certain aspects of finance processes, the introduction of AI is not an iterative update to those programs.

- In either case, accountants are responsible for data collection, cleaning, and report generation.

- Today we will look at how accounting software can improve your business’s efficiency and growth while saving you money.

- As technology progressed, cloud-based solutions emerged, offering real-time data access and collaboration.

- This not only speeds up processes but also diminishes errors significantly.

- When combined with machine learning, the bookkeeping software provides automated insights into a company’s financial data.

The right choice will empower you to maintain clear and organized records. Let’s dive into the list and find the best fit for your bookkeeping needs. Reducing the time it takes to optimize accounting processes and minimizing the burden on the team requires robust accounting automation software.

How AI is Transforming Bookkeeping for Small Businesses

Artificial Intelligence will play a pivotal role in predictive analytics, offering insights into financial trends and potential risks. AI-powered systems will analyze vast amounts of data to identify patterns and anomalies, enhancing fraud detection. Accountants use these insights to advise clients on strategic decisions. The top 4 use cases of automated bookkeeping in 2023 technology enables more accurate revenue projections and helps identify potential financial risks before they materialize. Cloud-based solutions often offer easier scaling options compared to on-premises systems. Integration capabilities with other software platforms should be evaluated to support future expansion.

Benefits of AI for Accountants and Small Businesses

Managing expenses and invoices has always been a significant part of bookkeeping. For businesses, it means gaining expert advice on leveraging their finances to achieve their goals. As AI takes over routine tasks, bookkeepers are evolving into strategic advisors. This creates a win-win situation for both businesses and their financial partners. Businesses can now customize dashboards, reports, and workflows to suit their specific needs. AI can track changes in tax regulations, providing your filings are always accurate and up-to-date.

Using AI to manage sensitive financial data comes with security concerns. Even with secure tools, it is important to make sure your data is safe from breaches or hacks. According to surveys, finance professionals report high levels of frustration with repetitive manual work and inefficiencies in the record-to-report process 2. Businesses can improve the financial procedures that include data input, reconciliation, and categorization to improve the company’s budget over time. For example, RecordMe can automatically conduct transactions and ensure they are in line with the multiple reporting standards in our database.

Cloud Solutions Enhance Accessibility and Security

It also reduces expenses related to data errors and compliance issues. This shift allows businesses to make faster, informed financial decisions. Monthly bookkeeping services that leverage AI technology offer more consistent and reliable financial reports. These services can adapt to the unique needs of different industries, making them a versatile tool for businesses. AI can identify patterns in financial data that may go unnoticed by human analysts.

In this way, the sheer velocity and volume will not distract from the nefarious activities that companies need to detect. Cloud-based accounting is the future, and Nomi is leading the charge. Whether you’re an independent bookkeeper or managing a large firm, embracing Nomi means efficiency, accuracy, and compliance at your fingertips. As a business owner, staying on top of your bookkeeping is essential to your success. Finding a bookkeeping automation system can help you keep your books up-to-date and accurate in real-time while saving time and money. Its robust features help companies of all sizes maintain accurate records and improve financial visibility.

Every invoice that the AP department receives must be approved right away. Paper bills may be lost or left on desks for weeks while they wait for approval. Through these programs, accountants can share their expertise, broaden their professional experience, and increase their overall importance within an organisation. Keeping files in actual storage spaces with endless documents is a challenge that many accountants are familiar with. It’s inconvenient to look all over the place, possibly even in a different building, for a file that needs to be studied. Accounting automation uses a software solution that may easily take the job to address many of the frequent issues described above.

The post Automating Bookkeeping: The Top 4 Use Cases And Benefits In 2025 first appeared on Esmeralda Colombiana.

]]>The post Retained Earnings: Definition, Formula and Examples first appeared on Esmeralda Colombiana.

]]>In essence, retained earnings give investors, managers, and stakeholders a glimpse into the financial well-being of the company. They offer insight into the business’s ability to sustain itself over time without relying heavily on external debt or continuous funding. Understanding how retained earnings play a role in financial stability is crucial for anyone involved in making general and administrative expense business decisions. On the other hand, how a company manages its retained earnings can affect the short-term returns shareholders receive.

Another ’30-Under-30′ Business Superstar Was Convicted of Fraud — This Time for Defrauding JPMorgan Chase Out of $175M

So, while the number of shares goes up, the value per share goes down, but it doesn’t mess with your balance sheet’s size. For example, if you give one share as a dividend to each shareholder, it’s like employer identification number cutting the pie into more slices – each slice gets smaller, but everyone still gets a piece. Rho offers powerful yet easy-to-use tools to simplify all your financial tasks, not just your statement of retained earnings. Let’s explain each step of the statement of retained earnings preparation process, with some examples.

- Retained earnings, also known as Member Capitol, can be found in the Equity section of your balance sheet under the heading Shareholder’s Equity.

- Appropriated retained earnings are those set aside for specific purposes, such as funding capital expenditures or paying off debt.

- Dividends refer to the distribution of money from the company to its shareholders.

- Basically, giving a stock dividend means sharing some of the profit with shareholders and giving them more ownership.

- This could signal financial instability, potentially lowering investor confidence and affecting the company’s market valuation.

Factors that can influence a company’s retained earnings

When a company is profitable and chooses to retain earnings, it demonstrates a forward-looking, growth-oriented approach that can lead to sustained financial success. Retained earnings are often viewed as a sign of financial strength and stability, especially when they grow over time. A company that continually retains earnings shows that it is generating consistent profits, which it chooses to reinvest rather than distribute. Finally, let’s consider a retail company facing some challenges in the market, leading to a decline in profits. The company’s net income for the year is only $100,000, and the management decides not to pay any dividends this year. Instead, the company retains all of the earnings to cushion the financial impact of the downturn and to maintain liquidity.

Retained earnings, shareholders’ equity, and working capital

Retained earnings offer internally generated capital to finance projects, allowing for efficient value creation by profitable companies. However, note that the above calculation is indicative of the value created with respect to the use of retained earnings only, and it does not indicate the overall value created by the company. Revenue is the money generated by a company during a period but before operating expenses and overhead costs are deducted. In some industries, revenue is called gross sales because the gross figure is calculated before any deductions. While no single financial ratio provides a complete picture, the TIE ratio offers a straightforward yet powerful gauge of solvency that complements other metrics in comprehensive financial analysis.

Limitations of the Times Interest Earned Ratio

Another widespread use of retained earnings is investing in other businesses or assets. That said, investing can also lead to profitable returns that you can use to grow your business further. If you use retained earnings for expansion, you’ll need to determine a budget and stick to it. Doing so will ensure that your company uses its earnings efficiently and maintains the right balance between growth and profitability. Retained earnings represent a critical component of a company’s overall financial health, as they indicate the profits and losses the company has retained.

Retained earnings are related to net (as opposed to gross) income because they reflect the net income the company has saved over time. Though the increase in the number of shares may not impact the company’s balance sheet, it decreases the per-share valuation, which is reflected in capital accounts, thereby impacting the RE. In the long run, such initiatives may lead to better returns for the company shareholders instead of those gained from dividend payouts. Paying off high-interest debt also may be preferred by both management and shareholders, instead of dividend payments. Management and shareholders may want the company to retain earnings for several different reasons. Being better informed about the market and the company’s business, the management may have a high-growth project in view, which they may perceive as a candidate for generating substantial returns in the future.

Our team of experts is here to provide you personalized support every step of the way. Explore our marketplace and find the perfect tool the goodwill value calculation of a retail store to streamline your processes today. Looking to streamline your business financial modeling process with a prebuilt customizable template? Say goodbye to the hassle of building a financial model from scratch and get started right away with one of our premium templates.

To calculate the increase in a business’s retained earnings, you must first divide the specific accounting period’s retained earnings against the beginning retained earnings of the same period. Then multiply this number by 100 to find out the percentage increase of your earnings within that period. Retained earnings provide a much clearer picture of your business’ financial health than net income can. If a potential investor is looking at your books, they’re most likely interested in your retained earnings. Your bookkeeper or accountant may also be able to create monthly retained earnings statements for you. These statements report changes to your retained earnings over the course of an accounting period.

- But if shareholder satisfaction and short-term returns are more important, especially in a stable or low-growth environment, paying dividends could be the better choice.

- The statement of retained earnings can help investors analyze how much money the company’s shareholders take out of the business for themselves, versus how much they’re leaving in the company to be reinvested.

- The key takeaway is that retained earnings are a reflection of a company’s ability to turn its profits into long-term value.

- To arrive at retained earnings, the accountant will subtract all dividends, whether they are cash or stock dividends, from the total amount of profits and losses.

- Retained earnings are the portion of a company’s historic profit that is ‘reinvested’ or ‘retained’, rather than distributed to shareholders as dividend.

As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy. This could include selling off assets, borrowing money, issuing new stock, or increasing productivity among its teams. You can use retained earnings to buy an asset, but retained earnings on their own are not assets.

The amount of retained earnings is calculated by adding the net income of the company to the beginning retained earnings and subtracting any dividend payments made to shareholders during the period. This calculation provides insight into a company’s ability to generate profits and reinvest them in the business. However, it’s important to remember that retained earnings aren’t just about accumulating profits. How a company balances retaining earnings with paying dividends is a critical decision that can affect shareholder satisfaction and business growth.

Furthermore, consistent retention of earnings reflects positive management decisions. It suggests that the company is not only profitable but also prudent in managing its profits. To find your shareholders’ equity (or owner’s equity) balance, subtract the total amount of dividends paid out from the beginning equity balance. Thus, you’ll have a crystal-clear picture of how much money your company has kept within that specific period. The statement starts with the beginning balance of retained earnings, adds net income (or subtracts net loss), and subtracts dividends paid.

Impact on Business Decision-Making

Companies can strengthen their financial stability and support long-term growth by keeping some profits within the business. To arrive at retained earnings, the accountant will subtract all dividends, whether they are cash or stock dividends, from the total amount of profits and losses. Our GAAP-compliant accounting services ensure you have up-to-date financial insights. Retained earnings serve as a crucial link between your income statement and balance sheet. This means they help connect your company’s profitability (shown in the income statement) with the financial health and equity (shown in the balance sheet). Your statement of retained earnings offers a clear view of how your business handles its profits, specifically detailing the profits retained after paying dividends to shareholders.

Related Terms

At 100,000 shares, the market value per share was $20 ($2Million/100,000), however, after the stock dividend, the market value per share reduces to $18.18 ($2Million/110,000). When your business earns a surplus income you have two alternatives, you can either distribute surplus income as dividends or reinvest the same as retained earnings. The business retained earnings balance of the previous year is the opening balance of the current year. The company retains the money and reinvests it—shareholders only have a claim to it when the board approves a dividend. Shareholders equity—also stockholders’ equity—is important if you are selling your business, or planning to bring on new investors.

On the other hand, a startup tech company might have a retention ratio near 100%, as the company’s shareholders believe that reinvesting earnings can generate better returns for investors down the road. You can find the amount on the balance sheet under shareholders’ equity for the previous accounting period. Sometimes when a company wants to reward its shareholders with a dividend without giving away any cash, it issues what’s called a stock dividend. Retained earnings are the portion of a company’s cumulative profit that is held or retained and saved for future use. Retained earnings could be used to fund an expansion or pay dividends at a later date.

Cash dividends represent a cash outflow and are recorded as reductions in the cash account. These reduce the size of a company’s balance sheet and asset value as the company no longer owns part of its liquid assets. At the end of each accounting period, retained earnings are reported on the balance sheet as the accumulated income from the prior year (including the current year’s income), minus dividends paid to shareholders. In the next accounting cycle, the RE ending balance from the previous accounting period will now become the retained earnings beginning balance.

For an analyst, the absolute figure of retained earnings during a particular quarter or year may not provide any meaningful insight. Observing it over a period of time (for example, over five years) only indicates the trend of how much money a company is adding to retained earnings. It involves paying out a nominal amount of dividends and retaining a good portion of the earnings, which offers a win-win.

The post Retained Earnings: Definition, Formula and Examples first appeared on Esmeralda Colombiana.

]]>The post What Does a Bookkeeper Do? A Simple Explanation Bench Accounting first appeared on Esmeralda Colombiana.

]]>Meanwhile, there will be cases when some customers won’t pay on the due date. When this happens, always assume that the customer might’ve forgotten about the payment and reach out to them via call or email. For more information, check out our article on how to ask for payment in an email and our detailed early payment discount guide. Julia is a writer in New York and https://avto-dny.ru/avtonovosti/24-stoit-li-zhdat-uluchsheniy-na-avtorynke-v-etom-godu-avto-novosti.html started covering tech and business during the pandemic.

EDUCATION & BEST DEGREES

- Those baby steps can help you manage your organization on a new and improved system.

- Businesses, regardless of the size, can benefit from accounting as it helps explain how you make money from selling goods and services.

- Though having a two-year or four-year degree isn’t always required to be hired as a bookkeeper, some companies may prefer candidates who do.

- Bookkeepers especially should be able to spot issues with daily expenses and make sure all the data points are tracked correctly.

This will allow you to quickly catch any errors that could become an issue down the road. Because bookkeeping involves the creation of financial reports, you will have access to information that provides accurate indicators of measurable success. By having access to this data, businesses of all sizes and ages can https://avto-dny.ru/avtonovosti/7400-ceny-uhodyat-v-otpusk-nebyvalaya-vygoda-do-200-000-rubley-na-novye-kia-avtonovosti.html make strategic plans and develop realistic objectives. A full charge bookkeeper works full time, as opposed to part time or as needed, and oversees all the accounts for a business or organization.

What skills do you need to become a bookkeeper?

It’s a great choice for any business that needs financial support and advice from its bookkeeping app. You can also quickly compare Xero with FreshBooks to make better business choice. A financial advisor or accountant can provide you with some guidance on the best type of bookkeeping software for your business. A bookkeeping course can teach you the basic knowledge you’ll need to prepare financial reports, organise data using tools like Microsoft Excel, and balance books.

Advance Your Accounting and Bookkeeping Career

The requirements will vary based on the organisation you work for and your responsibilities. However, the more education, training, and experience you have, the better your resume will look when you seek to fill a job vacancy. Experience the all-new TallyPrime 6.0 – connected banking, enhanced bank reconciliation, automated accounting, and integrated payments for effortless business management. As a partial check that the posting process was done correctly, a working document called an unadjusted trial balance is created. Column One contains the names of those accounts in the ledger which have a non-zero balance. If an account has a debit balance, the balance amount is copied into Column Two (the debit column); if an account has a credit balance, the amount is copied into Column Three (the credit column).

- My suggestion is to first read our free 13-part Bookkeeping Explanation and take our Bookkeeping Practice Quiz.

- Eric Gerard Ruiz, a licensed CPA in the Philippines, specializes in financial accounting and reporting (IFRS), managerial accounting, and cost accounting.

- The American Institute of Professional Bookkeepers (AIPB) can help prepare you for the national certified bookkeeper (CB) exam by training you in payroll, inventory, error correction, and more.

- In addition, smaller businesses may use single-entry bookkeeping, while larger businesses are more likely to use double-entry bookkeeping.

- It offers real-time cloud bookkeeping, and also gives you access to certified accountants.

- This level of security protects your business against data loss and gives you peace of mind knowing that your financial information is safe and always available when you need it.

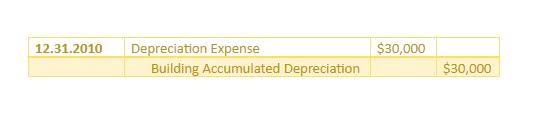

These assets are more suited to the double-declining balance method, which we discuss in detail in our guide to double-declining balance method. Fixed assets that are used relatively stable or uniformly can use the straight line method, which is explained in our straight line https://wojomarket.com/what-to-do-with-gift-cards-with-small-balances/ depreciation guide. For example, office desks and chairs often have uniform and single use. This method reports equal depreciation throughout the asset’s useful life.

Want to Build Your Own Bookkeeping Website in Minutes?

There are different types of bookkeeping services available, depending on the time and money investment you want to make. If you’re thinking about hiring a bookkeeper or want to clean up your business books, there are different bookkeeping types that can suit your needs. When an effective bookkeeping system is in place, businesses have the knowledge and information that allows them to make the best financial decisions. Tasks, such as establishing a budget, planning for the next fiscal year and preparing for tax time, are easier when financial records are accurate.

- The bookkeeper brings the books to the trial balance stage, from which an accountant may prepare financial reports for the organisation, such as the income statement and balance sheet.

- If you don’t have enough cash, try utilizing a line of credit to borrow quick cash.

- For example, all credit sales are recorded in the sales journal; all cash payments are recorded in the cash payments journal.

- It’ll let you work your way into the world of accounting and finance, something that will remain relevant until essentially the end of time.

NACPB’s certified public bookkeeper (CPB)

What’s better is that their assistance can also often save you money on small business tax preparation. Today, bookkeepers often work off-site or as freelancers which can benefit your business when it comes to cost. If you think about it, it’s usually much more expensive to hire an individual employee to have on-site. While you might be able to handle minimal incoming and outgoing transactions during the start-up phase, it will become increasingly complex and time-consuming—making a bookkeeper essential. The expected job decline is primarily due to cloud computing and other software innovations automating bookkeeping tasks that a person would normally do. Specializing in a career field can help to set you apart and lead to career stability and longevity.

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant. An outsourced bookkeeper is a third-party professional who’s been hired to handle your finances. A cash flow statement provides an overview of all your cash transactions. This can help forecast future cash flow conditions so you can plan for, say, a dry month. A bookkeeper prepares weekly, monthly, and quarterly financial reports. That said, depending on the type of bookkeeper or accountant you hire, and the situation you’re using them for, they may offer overlapping services.

The post What Does a Bookkeeper Do? A Simple Explanation Bench Accounting first appeared on Esmeralda Colombiana.

]]>The post The Least Squares Regression Method How to Find the Line of Best Fit first appeared on Esmeralda Colombiana.

]]>The Method of Least Squares: Definition, Formula, Steps, Limitations

There are two basic kinds of the least squares methods – ordinary or linear least squares and nonlinear least squares. During Time Series analysis we come across with variables, many of them are dependent upon others. It is often required to find a relationship between two or more variables. Least Square is the method for finding the best fit of a set of data points.

Examples of linear regression

The principle behind the Least Square Method is to minimize the sum of the squares of the residuals, making the residuals as small as possible to achieve the best fit line through the data points. The line of best fit for some points of observation, whose equation is obtained from Least Square method is known as the regression line or line of regression. For our data analysis below, we are going to expand on Example 1 about the association between test scores. We have generated hypothetical data, hsb2, which can be obtained from our website.

Hess’s Law of Constant Heat Summation: Definition, Explanations, Applications

This method is widely used in the field of economics, science, engineering, and beyond to estimate and predict relationships between variables. In that case, a central limit theorem often nonetheless implies that the parameter estimates will be cost accounting standards for government contracts approximately normally distributed so long as the sample is reasonably large. For this reason, given the important property that the error mean is independent of the independent variables, the distribution of the error term is not an important issue in regression analysis. Specifically, it is not typically important whether the error term follows a normal distribution. Dependent variables are illustrated on the vertical y-axis, while independent variables are illustrated on the horizontal x-axis in regression analysis. These designations form the equation for the line of best fit, which is determined from the least squares method.

The best fit result is assumed to reduce the sum of squared errors or residuals which are stated to be the differences between the observed or experimental value and corresponding fitted value given in the model. The method of least squares actually defines the solution for the minimization of the sum of squares of deviations or the errors in the result of each equation. Find the formula for sum of squares of errors, which help to find the variation in observed data. Least Square Method is used to derive a generalized linear equation between two variables. When the value of the dependent and independent variable is represented as the x and y coordinates in a 2D cartesian coordinate system.

The method of curve fitting is seen while regression analysis and the fitting equations to derive the curve is the least square method. Yes, there are several variations of the least squares method, each suited to different scenarios and assumptions about the data. Other variations include Weighted Least Squares (WLS) and Partial Least Squares (PLS), designed to address specific challenges in regression analysis. The least squares method is crucial for several reasons in economics and beyond.

A New Orthogonal Least Squares Identification Method for a Class of Fractional Hammerstein Models

The Least Square Method minimizes the sum of the squared differences between observed values and the values predicted by the model. This minimization leads to the best estimate of the coefficients of the linear equation. The red points in the above plot represent the data points for the sample data available. Independent variables are plotted as x-coordinates and dependent ones are plotted as y-coordinates. The equation of the line of best fit obtained from the Least Square method is plotted as the red line in the graph. Then, we try to represent all the marked points as a straight line or a linear equation.

- After having derived the force constant by least squares fitting, we predict the extension from Hooke’s law.

- Although the variable female is binary (coded 0 and 1), we can still use it in the descriptives command.

- The Least Square method provides a concise representation of the relationship between variables which can further help the analysts to make more accurate predictions.

- The least squares method is a form of regression analysis that is used by many technical analysts to identify trading opportunities and market trends.

- It begins with a set of data points using two variables, which are plotted on a graph along the x- and y-axis.

This will help us more easily visualize the formula in action using Chart.js to represent the data. The steps involved in the method of least squares using the given formulas are as follows. In order to find the best-fit line, we try to solve the above equations in the unknowns \(M\) and \(B\). As the three points do not actually lie on a line, there is no actual solution, so instead we compute a least-squares solution.

Setting up an example

The method of least squares grew out of the fields of astronomy and geodesy, as scientists and mathematicians sought to provide solutions to the challenges of navigating the Earth’s oceans during the Age of Discovery. The accurate description of the behavior of celestial bodies was the key to enabling ships to sail in open seas, where sailors could no longer rely on land sightings for navigation. Least squares is used as an equivalent to maximum likelihood when the model residuals are normally distributed with mean of 0. Following are the steps to calculate the least square using the above formulas. The two basic categories of least-square problems are ordinary or linear least squares and nonlinear least squares.

The Least Square method provides a concise representation of the relationship between variables which can further help the analysts to make more accurate predictions. The Least Square method assumes that the data is evenly distributed and doesn’t contain any outliers for deriving a line of best fit. But, this method doesn’t provide accurate results for unevenly distributed data or for data containing outliers. Let us have a look at how the data points and the line of best fit obtained from the Least Square method look when plotted on a graph. It is necessary to make assumptions about the nature of the experimental errors to test the results statistically.

Inequality of Sexes: Cause, Effects and Solutions

In this subsection we give an application of the method of least squares to data modeling. For our purposes, the best approximate solution is called the least-squares solution. We will present two methods for finding least-squares solutions, and we will give several applications to best-fit problems. Here’s a hypothetical example to show how the least square method works.

Thus, it is required to find a curve having a minimal deviation from all the measured 8 3 research and development costs data points. This is known as the best-fitting curve and is found by using the least-squares method. Let us look at a simple example, Ms. Dolma said in the class «Hey students who spend more time on their assignments are getting better grades». A student wants to estimate his grade for spending 2.3 hours on an assignment. Through the magic of the least-squares method, it is possible to determine the predictive model that will help him estimate the grades far more accurately.

- When the value of the dependent and independent variable is represented as the x and y coordinates in a 2D cartesian coordinate system.

- In 1810, after reading Gauss’s work, Laplace, after proving the central limit theorem, used it to give a large sample justification for the method of least squares and the normal distribution.

- The least square method is the process of finding the best-fitting curve or line of best fit for a set of data points by reducing the sum of the squares of the offsets (residual part) of the points from the curve.

- This is done to get the value of the dependent variable for an independent variable for which the value was initially unknown.

- This line is termed as the line of best fit from which the sum of squares of the distances from the points is minimized.

- This method, the method of least squares, finds values of the intercept and slope coefficient that minimize the sum of the squared errors.

What is Least Square Method Formula?

The equation that gives the picture of the relationship between the data points is found in the line of best fit. Computer software models that offer a summary of output values for analysis. The coefficients and summary output values explain the dependence of the variables being evaluated. The better the line fits the data, the smaller the residuals (on average). In other words, how do we determine values of the intercept and slope for our regression line?

Least Squares Regression

Least Square method is a fundamental mathematical technique widely used in data analysis, statistics, and regression modeling to identify the best-fitting curve or line for a given set of data points. This method ensures that the overall error is reduced, providing a highly accurate model for predicting future data trends. Least square method is the process of finding a regression line or best-fitted line for any data set that is described by an equation. This method what is inventory carrying cost requires reducing the sum of the squares of the residual parts of the points from the curve or line and the trend of outcomes is found quantitatively.

This minimizes the vertical distance from the data points to the regression line. The term least squares is used because it is the smallest sum of squares of errors, which is also called the variance. A non-linear least-squares problem, on the other hand, has no closed solution and is generally solved by iteration.

It’s a powerful formula and if you build any project using it I would love to see it. Regardless, predicting the future is a fun concept even if, in reality, the most we can hope to predict is an approximation based on past data points. It will be important for the next step when we have to apply the formula. We get all of the elements we will use shortly and add an event on the «Add» button.

Now, we calculate the means of x and y values denoted by X and Y respectively. Here, we have x as the independent variable and y as the dependent variable. First, we calculate the means of x and y values denoted by X and Y respectively. The presence of unusual data points can skew the results of the linear regression.

The post The Least Squares Regression Method How to Find the Line of Best Fit first appeared on Esmeralda Colombiana.

]]>The post 6+ Catering Receipt Templates Free sample, Example Format Download first appeared on Esmeralda Colombiana.

]]>Following this in many templates, there’s a section for the invoice number and date. These elements are vital for record keeping, tracking services, and managing payments. It is another best example for simple yet detailed invoice format. The invoice template captures all required details in one single page.

Sample Payment Received Receipt Letter – 6+ Examples in Word, PDF

Create your invoice templates directly in our app and keep your documents at one place and access them whenever you like. Businesses who accept prepaid orders or orders of large quantities to specific events can use the below catering request form. The request form captures customer details and food menu which need to be served during the event along with date and time of the event. The catering request form also captures contact person for billing with his contact number for any communication if required. This catering invoice form is available as an online editable pdf form. You can fill in the details and take a print out straight away without any need to convert the format into any word or excel format.

Restaurant catering invoice template has provision to include maximum and minimum guest count. Price per guest (child / adult), any service charge per hour, cost of the venue and any other expenses can be included in the rows so as to arrive at the total cost. This catering invoice is a formal doucment with details of billing, event details, services provided and offers included for the customer, etc. Handyman Invoice Templates -The handyman invoice template is specifically designed for contractors offering repair or maintenance services. It allows you to list labor charges, materials used, and the scope of work completed. This template is customizable, so you can easily tailor it to various handyman jobs, ensuring your clients are fully informed about the cost breakdown for every service provided.

How to Create a Catering Invoice That Will Get You Paid Fast

You can even add any specific notes to specify customer requirement in addition to what is printed in the catering invoice. This invoice gives provision to add tax to your catering invoice. The challenging chef mascot adds professional look to your catering business.

Doing this ensures both parties are on the same page and typically improves the relationship between client and provider. To download an invoice made specifically for quoting, check out the Proforma Invoice. With it, you can create a printer-friendly and fully customizable catering invoice that includes the essential invoicing elements. The invoice generator even calculates subtotals and the total amount due, minimizing accounting errors.

quick & easy tips for improving your catering invoice

- Invoice Templates Word -An invoice template word offers versatility and simplicity.

- However, there are also others who opt to provide a separate final catering receipt once all the payment has been made.

- These elements are vital for record keeping, tracking services, and managing payments.

- If you are looking to provide detailed menu items with short notes on guest numbers and price, this catering billing template would be the best fit.

- This catering invoice form is available as an online editable pdf form.

To help you get a head start, we’ve created a catering invoice that you can download for use! Choose from blue, gray, green, and yellow invoice templates to match your aesthetic. A catering invoice is a formal document sent by a catering service to its client after providing food and beverage services for an event. This invoice is not just a billing tool; it also serves as an official record of the transaction, useful for accounting and taxes. A typical catering invoice will detail the event specifics, the number of guests, the menu, service charges, and any extra services like setup and cleanup.

The main difference between an invoice and a receipt is its purpose. Meanwhile, a printable payment receipt is issued to customers after they have made their payment. Catering can be an extremely beneficial service for a variety of events and occasions. Perhaps the most obvious benefit of catering is that it can save someone hosting a party or event a great deal of time and effort in the kitchen. Catering can take care of all of the food preparation and cooking, leaving the host or organizer free to focus on other aspects of the event.

- If you want to create another kind of receipt and you need references and guides, you may use our Blank Receipt Template samples which you may all download in the provided link.

- List all catering services provided, such as food items, quantities, and per item or total service charges.

- If you are offering alcohol, even that needs to be added to the invoice to make it clear.

- You can add additional fields or columns like shipping details, discounts, additional charges, custom fields for both client and product or service line item.

- Excel’s built-in formulas make it easy to manage pricing, tax, and discounts automatically.

It’s important to research and understand the tax regulations in your area and consult with a tax professional catering receipt template to ensure compliance. Typically at the top of these templates, there’s an area for business information. This includes the name, address, and contact details of the catering company. It also includes client information such as the name, address, and contact details.

You can adjust fonts, add or remove sections, and personalize the layout. Word files are easily editable, allowing you to tailor each invoice to specific client needs while maintaining a consistent format for all your invoices. Having a standard catering invoice templates like these will help you to be more productive and can help to smooth the process of overall billing cycle by avoiding repetitive work.

Related templates

This method provides a digital record of the transaction for both parties. The applicability of taxes on catering services varies depending on the jurisdiction. In some regions, catering services may be subject to sales tax, value-added tax (VAT), or other local taxes.

Every catering business has unique needs, which is why customizable templates are invaluable. Add your logo, brand colors, and company policies to create consistent, on-brand invoices that impress clients. If you’re issuing a catering invoice, include your business and the client’s name and contact information, the services provided, and their respective price. Don’t forget to include all the important dates, the invoice number, tax, and discount if applicable.

Wedding catering invoice requires you to breakdown the entire menu that the client had ordered. This means that you mention every item of beverages, soups, starters and main food that are going to be served in the wedding. If you are offering alcohol, even that needs to be added to the invoice to make it clear. In the below catering bill invoice template, you may include list of items including beverages, food items, description of the food served, price and quantity.

Excel’s built-in formulas make it easy to manage pricing, tax, and discounts automatically. By using an Excel template, caterers can quickly update costs and generate invoices in bulk while maintaining precise financial records. Yes, a catering invoice can be customized to fit the specific needs of the catering company and the client. You can add your company’s logo, adjust the formatting, include specific terms and conditions, or even use a pre-designed catering invoice template to streamline the process. Musician Invoice Templates -A musician invoice template is essential for freelancers in the music industry. This template helps musicians detail services such as performance fees, session work, and any additional charges.

Adding the above listed catering terms and conditions in your catering invoice disclaimer will help to reduce any dissatisfaction through assumptions. If you want to create another kind of receipt and you need references and guides, you may use our Blank Receipt Template samples which you may all download in the provided link. Below are several more factors that contribute to the overall catering costs and need to be considered when planning an event. Aside from the usual columns like description and costs, the date when the cost was incurred can be added. As a best practice, it is always a good idea to include your payment instructions and expected due date in order to ensure you get paid quickly. Keep the track with our dashboard that gives you the greatest comfort for operating and monitoring your business.

To write a catering invoice, start by including your catering business’s name and contact details at the top, followed by the client’s information. List all catering services provided, such as food items, quantities, and per item or total service charges. Include any additional costs like setup fees, equipment rentals, or staff charges.

Don’t forget to include all the important dates, the invoice number, tax, and discount if applicable. You can customize it with your company name, slogan, logo and contact details. It’s great for individual DJs or music collectives, and there’s no coding required — just drag and drop to customize. Once the threshold of 20 documents is reached, you can buy our premium plans to keep continue creating the documents. Create the perfect invoice for your business with our Online Invoice Generator. It can be tricky to offer alcohol service at events if you have not yet acquired your liquor license.

The post 6+ Catering Receipt Templates Free sample, Example Format Download first appeared on Esmeralda Colombiana.

]]>The post Bookkeeper360 Review 2025: Pricing, Features & More first appeared on Esmeralda Colombiana.

]]>- If you decide to get this service, it should take less than two weeks to set up.

- This revenue source is not present in all months while merchandise licensing is consistent in almost all months.

- People who write reviews have ownership to edit or delete them at any time, and they’ll be displayed as long as an account is active.

- Managing bookkeeping can be overwhelming for small businesses, especially without the right technology.

- Our mission is to empower you to focus on what you do best while we handle the complexities of accounting.

Company Incorporation Services

After setting up your accounting system, you’ll be able to use the Bookkeeper360 cloud-based platform to communicate and work with your bookkeeper or accountant. Bookkeeping is the core service that Bookkeeper360 offers and is available by signing up for a consultation with its U.S.-based team. Our 100% US-based team utilizes technology to manage your accounting with a personalized touch. If your business needs CFO advisory services, the company can include them in a custom package. It will ensure you are using the correct software and accurate data for top-notch security and error-proof business financial operations.

- Their weekly plan will get you a dedicated accounting team, in addition to advanced reporting metrics.

- Plus, with Bookkeeper360’s custom plans, you can pick and choose which services you want and receive a solution that will truly accommodate your specific business.

- What we like about this chart is that you can see the cost behavior of different cost drivers in the business.

- Lastly, the app is synced hourly, so you’ll always have the freshest data available.

It covers invoicing, bill payments, collection services, inventory management, and POS and ERP integration. Tax services pricing depends on whether you need help with individual or business filings. An individual and business filing will cost you $200 and $800 bookkeeper360 review per filing, respectively. This plan also covers tax planning, filing for R&D tax credit, sales and use taxes, and 401(k) planning. This company’s pricing varies heavily and depends on the services and features you need. Thankfully, you can find the clearly outlined starting prices on its website.

We champion verified reviews

In addition, Bookkeeper provides better onboarding support through to completion. FreshBooks offers four pricing plans, with the entry plan priced at $8.50. Navigating the small business accounting software offerings available today can feel like venturing into a maze – but …

If you are looking for an alternative bookkeeping option, you should consider Bench, another online bookkeeping services provider. However, Bench is more tech-oriented and comes with its own bookkeeping software. This company’s proprietary mobile app is one of the solutions many small-business owners will find useful for navigating their business finances in an easy-to-understand manner. You will be able to effortlessly track revenue, costs, and expenses, as well as tackle payroll management, cash flow, and much more. This company hires experienced accountants only, so when you sign up for its bookkeeping services, your business gets a dedicated expert. They will quickly learn all about your business and start crunching the numbers.

Does Bookkeeper360 offer a free version?

Cloud-based outsourced bookkeeping solutions offer a smarter, more efficient way to handle … Under cash-basis accounting, revenues and expenses are recorded when cash is paid or received. Meanwhile, accrual accounting records revenue and expenses when earned or incurred. Learn more in our cash- vs accrual-basis accounting method comparison, which also covers when to use each. Trends show you business revenues, direct costs, and operating expenses along its composition.

For example, Catch Up and Retro Bookkeeping includes bringing your books up to date from a time before you started using Bench’s services. The three subscription plans for core bookkeeping services are listed below. Any services beyond bookkeeping—such as payroll, HR, taxes, or keeping your books up-to-date—are available at an additional cost.

Online Stock Trading Platforms

Another benefit of using this software is that you can reconcile your accounts monthly with your general ledger. People who write reviews have ownership to edit or delete them at any time, and they’ll be displayed as long as an account is active. I meet with them 4x a year to go over everything and my books are great and in January I have all my tax documents i need. The cash runway, also called cash burn rate, shows the estimated number of months until cash runs out.

Up to $35,000 in Monthly Expenses

Say goodbye to the stress and unexpected financial surprises that arise from poorly maintained books and unreliable accounting. We are dedicated to offering you precise and prompt financial insights regarding your operations. You launched your business to pursue your passion, not to manage an accounting function. Our expert team, composed of CPAs, advisors, and tech specialists, possesses the resources necessary for your success.

Bookkeeping Software

Bookkeeping.com is a great Bookkeeper360 alternative if you already use QuickBooks and prefer pricing based on transactions. This software is ideal for remote businesses looking for an all-rounded platform. It started as an online bookkeeping software with an integrated bookkeeping service. You can generate reports, track expenditures, payments, and more through it. Are you a business owner or CFO struggling to track your company’s financial performance?

You can expect your advisor to handle your business and financial plans and create a capital deployment strategy. They can also provide you with the projections and forecasts necessary for running your business effectively. What’s more, entrepreneurs can also rely on this service for coaching and for-profit, cost, and margin analysis. I hired Bookkeeper360 initially to help with a migration from QuickBooks to Xero.

Like Bookkeeper360, Bookeeper.com is a U.S.-based online bookkeeping service provider that works with small businesses. With the Weekly plan, you’ll receive a dedicated accountant who will perform your bookkeeping on a weekly basis. This plan will also include cash and accrual basis accounting and reporting, as well as invoice and expense management, technology consulting, monthly financial reviews and weekly catchup calls. Plus, with transparent pricing laid out for customers to see, a service provider can’t try and charge you more than it does someone else. The features you receive with Bookkeeper360 will largely depend on what your business needs and what kind of strategy you develop in your consultation. Ultimately you can choose services that range from advisory support to full, hands-on bookkeeping management.

For technology integration and assistance, the Bookkeeper360 website states that once available, the 360app will be included in all service packages. Other custom integrations are priced per project, and you have to work with the Bookkeeper360 team directly to determine this cost. This company is an excellent solution for small businesses that can’t afford an in-house accounting team. Its various plans contain all the necessary services for handling your books, taxes, and even payroll and HR responsibilities, for a relatively affordable price. Bookkeeper360, founded in 2012, is a financial technology firm that offers accounting and cloud-based bookkeeping and business advisory services.

The team can also set up the integration of ERP and your point-of-sale systems. Bookkeeper360 quickly became one of the top-rated bookkeeping solutions on the market after its founding in 2012. The CEO and founder, Nick Pasquarosa, used his extensive experience in implementing technology for solving accounting and bookkeeping issues to create an all-in-one bookkeeping solution for SMEs and startups.

The post Bookkeeper360 Review 2025: Pricing, Features & More first appeared on Esmeralda Colombiana.

]]>The post Phantom Equity vs Profits Interest first appeared on Esmeralda Colombiana.

]]>While it may seem enticing to present a rosy financial picture, businesses that rely on phantom profit expose themselves to a range of consequences that can ultimately harm their long-term viability. The terms phantom profits or illusory profits are often used in the context of inventory (but can also pertain to depreciation) during periods of rising costs. Unraveling the deception of phantom profit is no easy task for businesses striving to accurately gauge their performance. Phantom profit, also known as illusory or fictitious profit, refers to misleading financial gains that do not translate into actual cash flow. While it may initially seem like a positive sign for a company, phantom profit can distort financial statements and mislead stakeholders, ultimately undermining the true health of the business.

Different methods can have a significant impact on the timing of revenue recognition, which in turn affects the calculation of profit. For instance, the completed contract method recognizes revenue only when a project is completed, while the percentage of completion method recognizes revenue based on the progress of the project. Each method has its own advantages and disadvantages, and businesses must choose the one that aligns best with their operations and goals. Companies may engage in practices such as capitalizing costs that should be expensed immediately or understating liabilities to create the illusion of higher profits. One common example is the capitalization of research and development (R&D) costs instead of expensing them as incurred. By capitalizing these costs, a company can delay their recognition as expenses, leading to higher reported profits.

AUD CPA Practice Questions: Sampling Methods

Companies may allocate costs incorrectly among different products, services, or business units, leading to distorted profit figures. For example, a manufacturing company may allocate overhead costs based on outdated or arbitrary allocation methods, resulting in certain products appearing more profitable than they actually are. Phantom profit is a deceptive financial concept that arises when accounting methods do not accurately reflect the economic reality of a business.

Other Factors In Applying The Lower Of Cost Or Market Rule

And even though zero-coupon bonds make no payments until maturity, their holders may be liable for local, state, and federal taxes on to the amount of their imputed interest. This type of phantom income can be offset by purchasing tax-free zero-coupon bonds or tax-advantaged municipal zero-coupon bonds, in addition to zero-coupon bonds. A phantom profit is a tax advantage that results in no real economic benefit to the taxpayer.

Expect more firms to follow as they realize the possible benefits of implementing phantom stock for employee compensation campaigns. The nonprofit performing arts have received substantial attention in the cultural economics literature, and represent an interesting application for many areas of economic inquiry. The additional profit from this difference in depreciation is considered to be illusory profit. This smaller amount of costs charged to the income statement means reporting greater profit. Ensuring that employees understand the importance of accurate reporting can significantly contribute to sustainable success.

- Like any genuine stock, phantom stocks rise and fall in value in line with the underlying company stock, and staffers are compensated with profits incurred from any company stock appreciation on specific dates.

- This involves looking beyond short-term gains and focusing on sustainable growth and long-term profitability.

- GAAP doesn’t allow the use of replacement cost since that violates the (historical) cost principle.

- When analyzing the financial performance of a company, it is crucial to understand the concept of phantom profit and its implications on financial statements.

We promise we won’t bore you with the accounting stuff.

Also, companies can include provisions in a phantom stock agreement that “forfeits” any phantom stock benefits if the employee in question departs the company before the agreed vesting completion date. Phantom stocks are a form of employee compensation that gives employees access to stock ownership without actually owning the stock. Like any genuine stock, phantom stocks rise and fall in value in line with the underlying company stock, and staffers are compensated with profits incurred from any company stock appreciation on specific dates.

AccountingTools

For example, measuring customer satisfaction, employee engagement, and innovation can provide a more comprehensive view of the business’s success. By aligning KPIs with the company’s mission and long-term goals, decision-makers can make informed choices that drive sustainable growth. When it comes to phantom profit, it is crucial for businesses and investors to critically evaluate the financial statements and understand the underlying causes. While the use of accrual accounting and non-cash charges are necessary for accurate financial reporting, it is essential to recognize their limitations.

It is crucial for businesses to carefully analyze their cost structure and implement cost allocation methods that align with their operations and goals. This ensures that phantom profit is minimized, and performance evaluation is accurate and meaningful. One of the key strategies to minimize phantom profit and improve performance evaluation is to carefully analyze revenue recognition methods.

- By conducting regular audits, businesses can mitigate the risk of phantom profit and maintain transparency in their financial reporting.

- This is a simplified example, but it shows how accounting methods can sometimes create the appearance of profit where there isn’t one.

- A probability used to determine a «sure» expected value (sometimes called acertainty equivalent) that would be equivalent to the actual risky expected value.

- Lastly, the failure to account for financing costs can contribute to phantom profit.

Consequences for Businesses

Another common culprit behind phantom profit is the overstatement of asset valuation. Companies may inflate the value of their assets, such as inventory or property, plant, and equipment, to make their financial position appear stronger than it actually is. This can be done by either overestimating the fair value of assets or by not recognizing necessary write-downs.

They may rely on inflated profit figures to justify investments, expansion plans, or executive bonuses. However, when the time comes to convert these paper gains into real cash, the truth behind the illusion is revealed, often leading to financial distress and potential bankruptcy. To illustrate the impact of phantom profit, let’s consider the case of XYZ Corporation. The company experienced a sudden surge in sales due to a viral social media campaign, resulting in a substantial increase in revenue. However, upon closer examination, it became evident that this growth was driven by a temporary fad, and the company had not made any efforts to retain these customers or build a loyal customer base. As a result, XYZ Corporation’s profit figures were inflated, masking the underlying issues of poor customer retention and a lack of sustainable growth.

Companies that borrow funds to finance their operations often incur phantom profit formula interest expenses. If these expenses are not properly recognized, the reported profits will be inflated. For instance, a company that fails to record interest expenses on its outstanding loans will overstate its profit figures. To avoid this, businesses should diligently record and allocate financing costs, including interest expenses, to the relevant periods and ensure accurate financial reporting.

Employees who hold phantom equity do have a claim on the economic value and growth of the company. Phantom stock plans can be both a good employee motivation tool for employers and a solid cash incentive plan for employees. Phantom income can pose challenges for taxpayers when it is not planned for because it can create an unexpected tax burden. These indicators should go beyond traditional financial metrics and encompass a range of factors that reflect the company’s overall health.

Phantom profit can distort a company’s financial performance and mislead stakeholders. By understanding and unmasking the common sources of phantom profit, businesses can make informed decisions based on accurate financial information. By carefully considering and implementing these strategies, businesses can ensure that their financial statements accurately reflect their performance and make informed decisions based on reliable information. Unraveling the deception of phantom profit requires diligence, transparency, and adherence to ethical practices.

These tools enable a deeper understanding of financial data, allowing for the identification of potential discrepancies or irregularities. By utilizing such tools, businesses can gain valuable insights into their financial performance and take proactive measures to address any phantom profit scenarios. Phantom stock is essentially a simulation of stock distribution that protects equity from further dilution but allows employees to gain from company share growth financially. Your choice can result in drastic variations in the cost of goods sold, web income and ending inventory. Therefore, many corporations in the United States use LIFO even when the method doesn’t precisely mirror the actual move of merchandise through the corporate. Departing employees will need to be paid cash compensation for the value of their equity.

This can distort the true financial health of a business and mislead investors, creditors, and other stakeholders. In this section, we will explore the various impacts of phantom profit on financial statements, providing insights from different perspectives and offering comparisons to identify the best course of action. Detecting phantom profit requires a meticulous examination of a company’s financial statements and accounting practices. One crucial indicator is a significant divergence between reported profits and cash flows. While profits may appear robust, a closer look at cash flow statements may reveal a lack of corresponding cash inflows. Additionally, a thorough analysis of revenue recognition policies, expense accruals, and capitalization practices can uncover potential instances of phantom profit.

The post Phantom Equity vs Profits Interest first appeared on Esmeralda Colombiana.

]]>The post Absorption Costing vs Variable Costing: What’s the Difference? first appeared on Esmeralda Colombiana.

]]>Costing methods are the backbone of financial analysis and decision-making in the business world. They provide the framework for determining the cost of products, projects, or services, which in turn influences pricing, budgeting, and strategic planning. Two of the most widely discussed costing methods are variable costing and absorption costing.

- In conclusion, absorption costing and variable costing are two distinct methods of cost allocation that differ in their treatment of fixed manufacturing overhead costs.

- As a result, if a company employs variable costing, it may also be required to utilize absorption costing (which is GAAP-compliant).

- It requires a careful consideration of the company’s operational, financial, and strategic objectives.

- The key distinction between absorption costing and variable costing is how fixed overhead costs are treated.

- It can result in higher reported profits when sales volume exceeds production volume.

- This is because fixed manufacturing costs are spread over more units when production volume is high, but they are not spread over any units when production volume is low.

- The differences in expense recognition between variable and absorption costing can significantly affect financial outcomes and managerial strategies.